Should We Blame Blackrock For Eroding Shareholders’ Assets Value And For Aggravating Global Heating In The Process? ESG, Fiduciary Duty And Active Ownership in Passive Investing.

The Guardian published a damning article featuring Blackrock, the world’s largest fund manager by assets under management. The piece cites an IEEFA research paper, arguing the asset management behemoth ‘lost $90 billion over the last decade through its holdings in fossil fuel companies […] by betting on oil companies that were falling in value and by missing out on growth in clean energy investments‘ (singling out the oil majors -ExxonMobil, Chevron, Royal Dutch Shell and BP as main culprits).

Arguably, this is not as black and white as it may seem at first. Far from exonerating Blackrock (fair to assume they will be just fine even without this sort of moral support), it is important to understand some of the complexities here, which IEEFA and Guardian don’t seem to acknowledge.

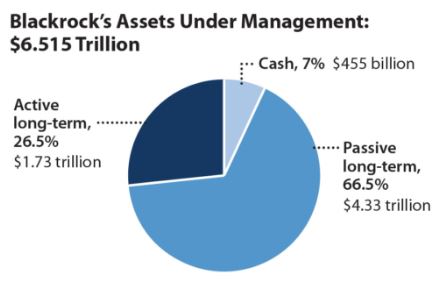

The starting premise of the report is a valid point: a firm responsible for management of over $6 trillion of assets (for comparison, all of UK’s GDP is just over $3 trillion) has a tremendous influence on businesses it owns and a huge political clout. For those reasons alone, it should certainly be scrutinised on its stance on global heating and held accountable should it fall short not just of its legal obligations (this goes without saying), but also of industry’s best practice standards in terms of its ESG risk management.

The urgent need for divestment from fossil fuels allowing to channel capital into development of renewables is widely accepted – even oil producers pretend to agree with that. However, both the newspaper article and the report seem to be conflating Blackrock’s fiduciary duty towards investors (a legal obligation to prioritise investors financial interest above any other consideration) and ‘its responsibility for leading on the climate emergency‘. As it stands, the latter is solely a moral requirement, which, under current legislation, may even be in conflict with the former. Whether the understanding of fiduciary duty is compatible with the challenges of global heating and environmental collapse is a completely separate question.

Let’s get a few facts in order first.

Firstly, as the IEEFA report admits, majority off assets managed by Blackrock are locked in passive funds, i.e. funds which track a given index – FTSE 100, S&P 500, STOXX 600, etc.. Their job is not to outperform an index or shield investors from decline in the value of their assets, but merely to mirror the movements of an index. Equally, should a renewables focused firm meet the index criteria, a passive fund manager will automatically rebalance the fund and increase its holdings in this company.

The report does not distinguish between Blackrock’s actively managed funds and passive ones when quoting the $90bn loss. It is not very clear what is meant by ‘underperforming the market’ – it sounds like a reference to a benchmark (S&P 500? MSCI World Index?) rather than absolute value returned to investors over time. In either case, this would only be a valid criticism in case of actively managed funds, where an actual investment decision making process takes place.

Source: IEEFA

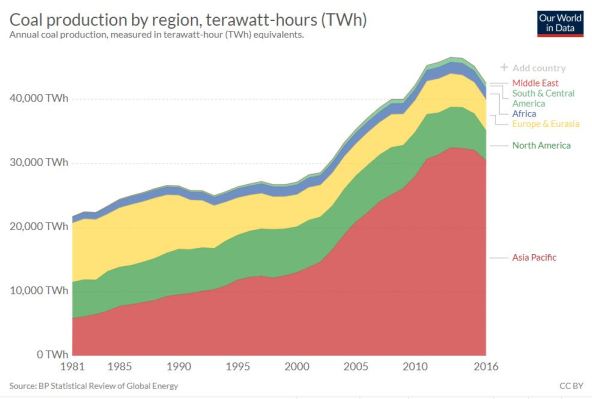

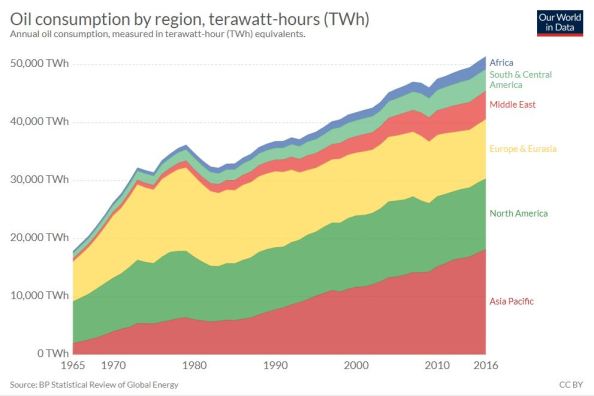

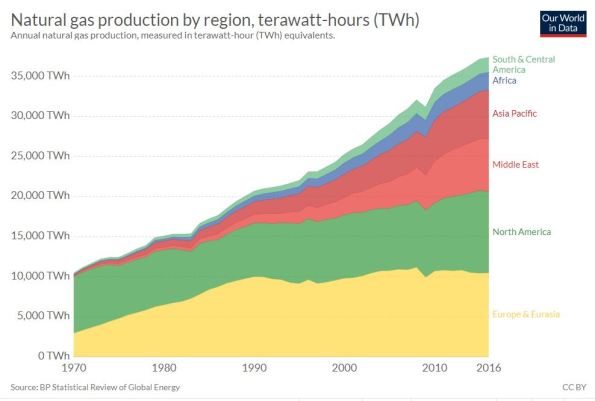

Another claim, which needs further scrutiny: ‘any reasonable assessment of stranded asset risks relating to climate change would recognize that coal and gas turbine demand has been clearly impacted by a global pivot towards renewable energy‘. Seeing revenues and share prices of fossil fuel producing companies falling because our dependency on oil, gas and coal was coming to an end would be welcome. Sadly, whilst this may be the case if we look at coal-based energy production, a quick look at oil and natural gas consumption chart shows the picture is far more nuanced:

Fig. 1: Coal-based energy production is dropping sharply

Fig. 2 & 3: Not the case for oil and gas

Where IEEFA report potentially makes a very good point though, is that passive investing should not mean passive ownership. If Blackrock board members indeed tend to simply align with management decisions and fail to support climate change initiatives by other shareholders, this raises a valid question whether Blackrock has done enough to protect its investors from ESG risks. In any case, this relates primarily to the ‘S’ and ‘G’ – societal risks stemming from awareness that a given company is not doing enough to reduce the environmental harm it is causing (for example more stringent regulations) or poor management transparency.

Unfortunately, contrary to what IEEFA and The Guardian attempt to argue, as long as investments in fossil fuel are both legal and profitable, ESG considerations alone are not the right tool to engage global finance in tackling of global heating – the search continues.

Interesting article – keep up the good work!

It’s an interesting question whether passive investment should equal passive ownership. In practice, as far as I know, index funds tend to outsource decision making to shops such as ISS; the reason for that is twofold and inter-related:

1) governance decisions impact valuations, which impact passive investors’ holdings

2) active investment management (selection as well as governance) is expensive

How proxy voting firms arrive at their recommendations is another question altogether!

Good point, proxy voting is probably a cost-cutting exercise, allowing for the 10 bps charges on trackers. Didn’t think about it from this angle. I don’t think IEEFA considered it either…

Indeed! ETF providers are able to remain competitive by running very lean cost bases; if one was to invest in governance analysis, it would bear all the cost and give a freebie to its competitors (in the form of improved market efficiency / price discovery).

Matt Levine wrote about the proxy voting industry here: https://www.google.co.uk/amp/s/www.bloomberg.com/amp/opinion/articles/2018-01-30/iss-tells-investors-how-they-want-to-vote; it’s worth bearing in mind many decisions that shareholders vote on are on less societally involved matters which can also be pretty technical (eg M&A).